In January 2023 the sustainability field was shocked by the divulgation of academic studies that pointed invalidity of 90% of rainforest offset carbon credits of Verra, the biggest world releaser of carbon credits through its Verified Carbon Standard (VCS) Program. The scenario reveals the underlined problems of this market, which increased disproportionally in the last years, and carries within its concept diverse critics among specialists, although attracting constantly higher investments. This article aims to introduce basic knowledge of carbon credits with a focus on REDD+ credits, those focused on reducing emissions from deforestation and forest degradation, analyzing their dynamic and fragility of methodology also through a simplified graphical intuition.

Long path trajectory

Although largely implemented within the last five years, the concept of the carbon credits system was introduced in 1987 in the UN Kyoto Protocol. The protocol was the first big international cooperation focused on the reduction of greenhouse gases (GHG), intending to reduce emissions by an average of 5.2 per cent below 1990 GHG levels by the year 2012. During the early 2000s, the concept was most studied and analyzed in the academic sphere, with a lower incentive for adoption in the global economic system, and gradual development of a volunteer market. In following years, due to the gradual increase of visibility of environmental damage, a greater focus on sustainable transformation was given, mainly represented by the Paris Agreement of 2015, aiming to limit the global temperature increase to 1.5°C above pre-industrial levels, as visualized within the predictions of graph 1.

During the 2018 United Nations Climate Change Conference (COP 24), there was already strong pressure for standardization and regulation of the carbon market. But was the COVID-19 period that marked immense attention to environmental impact, as the Voluntary Carbon Markets (VCM) advanced in proportion, structure and demand. Also, one main focus of COP26 (2021) was setting the goal of reducing global carbon dioxide emissions by 45 per cent by 2030 relative to the 2010 level.

In this way, in the past 5 years, the carbon credits expanded at a higher rate than in two entire decades. Today, the carbon market produces around $2bn annually, with predictions from McKinsey consultancy of becoming $50bn a year by 2030.

This abrupt value increase is a direct consequence of the “current trend” of sustainability in the economic system and the expansion of incentives by governments. The demand for carbon credits becomes disproportional to the number of genuine credits, and through not well-structured standards, reflects in the invalidity of a significant fraction of credits on the market. Therefore, a red flag should rise for the next years as investments in the sector increase, frauds like greenwashing emerge, and the planet’s environment continues to be damaged.

Baseline concept

The basic concept of a carbon credit is a tradable certificate which gives the holder the right to emit one tonne of carbon dioxide. The certificate was given as an attempt to include GHG mitigation into the economic system, making the private institutions directly responsible for “decreasing” its emissions. Thus, through a “commoditization” process, a standard price is set to the carbon credit, turning it into a tradable asset.

In this way, the trade of carbon credits would be systematically stimulated, by governmental policies defining limits, or “caps”, of emissions for specific economic fields. The credits would be an instrument of sustainable transformation as an asset.

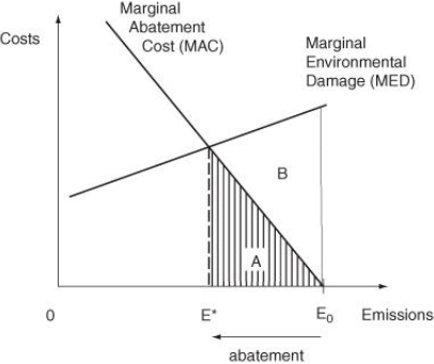

This reasoning can be represented by a simplified diagram given by the relationship between emission level (horizontal axis) and total cost of emissions abatement (vertical axis).

From the diagram, the Marginal Abatement Cost (MAC) is negatively related to the emissions level (negative slope) since the cost is proportional to the emission reduction. In the opposite way, the Marginal Environmental Damage (MED) has a positive relationship to the emissions level (positive slope), as the higher is the emissions, more is the environmental impact. For a reduction in emission from E0 to E*, the total abatement costs are area A, the total environmental benefit from the abatement is the sum of area A and B and the total net benefit for society is the difference between the amounts, thus area B.

The optimal level of emissions is the one that maximizes the net benefit of society, thus the intersection point between the MAC and MED.

Applying this baseline diagram, carbon credits are the instrument for emission abatement, and therefore the cost is the credits price. In this way, the optimal level of emission reduction is given by an optimal price level and quantity. This crucial point is where REED+ credits can break the ideal dynamic, as explained following.

Understanding REED+

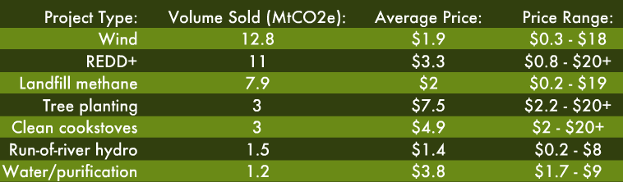

REED+ carbon credits are those regarding reducing emissions from deforestation and forest degradation. The REED concept was first introduced in COP11, 2005, aimed at incentivizing reforestation and the role of conservation, sustainable management of forests, and enhancement of forest carbon stocks in developing countries. During several steps on its structuring, REED+ became incorporated in a market-based approach through carbon credits, which today are the second most sold in volume as shown in table 1.

Since its conceptualization 18 years ago, the REED+ initiatives are analyzed and structured by international institutions such as the Intergovernmental Panel on Climate Change (IPCC). A process made through COPs conferences, stating methods of measurement, reporting and verification mostly to governmental national-based implementation.

Since they represented a direct instrument for the maintenance of tropical forests in countries in development, REED initiatives became a major investment attractor in the international sphere. As with the US$1 billion investment of the Norwegian government towards the Brazilian REDD scheme back in 2007.

In this way, the basis of REED organizations was already developed when the carbon credits market expanded in the last years, attracting new initiatives and achieving high market potential.

Dynamics in doubt

Besides complex requirements and bureaucracy, the disproportional demand through the credits market of the last years revealed in expressive inefficiencies of the REED+ system.

REED+ initiatives release carbon credits through standard methods of international organizations. Verra, based in Washington DC, is the main global standard organization as it issued more than 1bn carbon credits with its Verified Carbon Standard (VCS). It approves three-quarters of all voluntary carbon credits in the market. And its rainforest protection program makes up 40% of the credits it approves.

The main problem emerges with a gap in the methodology of the standard. Initiatives of forest management can speculate how many carbon credits it is avoided being emitted as the initiative exists, by a concept called Additionality. This mechanism is the door for over-speculation of sustainable impact, all occurring in accordance with Verra’s rules. A range of academic research, with emphasis on Stanford and Cambridge, presents the possibility of 94% of rainforest projects’ credits having no benefit to the climate. With the most wide-ranging analyzing two-thirds of 87 Verra-approved active projects.

The over-speculation of threat to forests had been about 400% on average, according to the analysis of the 2022 University of Cambridge study. A driving factor for this phenomenon was the increasing rates of deforestation and the climate crisis of Jair Bolsonaro’s government in Brazil (2019-2022), matching the “boom” in credits demand. However, unfounded arguments are presented in such scenario, as projects in protected areas or hundreds of kilometres from the real threatened areas expressively increased its credits emissions.

Diagram intuition

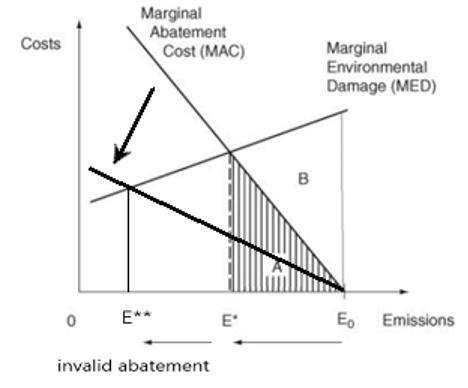

Applying this scenario on the baseline diagram, the over-release of carbon credits generates a lower optimal price (cost) through lower Marginal Abatement Cost (MAC), represented by a flatter slope.

Moreover, higher levels of emission abatement are shown due to the over-release of credits, based on over-speculation. In this way, the speculation gap ends up permitting more firms to show themselves as “net zero” while releasing invalid credits, and not really decreasing emissions.

Conclusion

The carbon credits market was created as an instrument of sustainable transformation, by including GHG emissions reductions directly into the economic system. However, due to a disproportional increasing demand, gaps in crucial methodologies made possible massive releases of invalid credits, as represented by the REED+ cases. Such invalidity is beyond bureaucratic parameters, but its main purpose, reversing the environmental damage on the planet. Therefore, the international entities which aim to enforce the climate agreements must press the carbon credit market to functionates as its baseline concept, finding the optimal equilibrium between economic constraints and environmental maintenance. While institutions with the goal of becoming truly net-zero must reduce their own emissions as the main focus, whilst using carbon credits that really generate a positive impact.

Unfunded carbon credits release, as by the over-speculation, permit firms to emit GHG and pollute the environment, but with the “mask” of sustainable abatement. Therefore generating the exact opposite effect of its objective and retarding the race against environmental devastation.

By Lucas Baso Lestido

Bibliography:

- ● Smith, Stephen, Environmental Economics: A Very Short Introduction, Very Short Introductions (Oxford, 2011; online edn, Oxford Academic, 24 Sept. 2013);

- Tol, R. S. J. The Stern Review of the Economics of Climate Change: A Comment. Energy & Environment, 2006

- Betz, R., Michaelowa, A., Castro, P., Kotsch, R., Mehling, M., Michaelowa, K., & Baranzini, A. (2022). The Carbon Market Challenge: Preventing Abuse Through Effective Governance (Elements in Earth System Governance). Cambridge: Cambridge University Press;

- West, T.A.; Börner, J.; Sills, E.O.; Kontoleon, A. Overstated carbon emission reductions from voluntary REDD+ projects in the Brazilian Amazon. Proc. Natl. Acad. Sci. USA 2020;

- Guizar-Coutiño A, Jones JPG, Balmford A, Carmenta R, Coomes DA. A global evaluation of the effectiveness of voluntary REDD+ projects at reducing deforestation and degradation in the moist tropics. Conserv Biol. 2022;

- Austin, K.G., Baker, J.S., Sohngen, B.L. et al. The economic costs of planting, preserving, and managing the world’s forests to mitigate climate change. Nat Commun 11, 5946 (2020)

- Satyakti, Yayan. (2011). Renewable Energy Economics in Developing Countries;

- Anderson, K. The inconvenient truth of carbon offsets. Nature 484, 7 (2012)

- van der Werf, G., Morton, D., DeFries, R. et al. CO2 emissions from forest loss. Nature Geosci 2, 737–738 (2009)

- United Nations Collaborative Programme on Reducing Emissions from Deforestation and Forest Degradation in Developing Countries 2018-11-19

Articles:

- The Guardian, “Revealed: more than 90% of rainforest carbon offsets by biggest certifier are worthless, analysis shows”, 18.01.2023

- The Guardian, “Greenwashing or a net zero necessity? Climate scientists on carbon offsetting”, 18.01.2023

- https://www.theguardian.com/environment/2023/jan/18/greenwashing-or-net-zero-necessity-climate-scientists-on-carbon-offsetting-aoe

- BCG, “The Voluntary Carbon Market Is Thriving”, 19.01.23

https://www.bcg.com/publications/2023/why-the-voluntary-carbon-market-is-thriving?linkId=198282589

- Yale Environment 360, “Is the ‘Legacy’ Carbon Credit Market a Climate Plus or Just Hype?”,09.03.2021

https://e360.yale.edu/features/is-the-legacy-carbon-credit-market-a-climate-plus-or-just-hype

- Oxford News and Events, “Oxford launches new principles for credible carbon offsetting”, 19.10.2020

https://www.ox.ac.uk/news/2020-09-29-oxford-launches-new-principles-credible-carbon-offsetting

- McKinsey Sustainability, “A blueprint for scaling voluntary carbon markets to meet the climate challenge”, 29.01.2021

- The Guardian, “The truth behind corporate climate pledges”,26.07.2021

https://www.theguardian.com/environment/2021/jul/26/climate-crisis-green-light

- Bloomberg, “These Trees Are Not What They Seem, How the Nature Conservancy, the world’s biggest environmental group, became a dealer of meaningless carbon offsets.”,09.12.2020

Websites:

- Cambridge Centre for Carbon Credits (4C), “Algorithms to classify nature-based projects”, https://4c.cst.cam.ac.uk/about/algorithms-classify-nature-based-projects

- United Nations Climate Change, “What is REDD+?”,https://unfccc.int/topics/land-use/workstreams/redd/what-is-redd

- Carbon Offset Guide, “Additionality”, https://www.offsetguide.org/high-quality-offsets/additionality/

- Carbon Offset Guide,” Mandatory & Voluntary Offset Markets”, https://www.offsetguide.org/understanding-carbon-offsets/carbon-offset-programs/mandatory-voluntary-offset-markets/

- Energy Education, “Carbon tax vs emissions trading”, https://energyeducation.ca/encyclopedia/Carbon_tax_vs_emissions_trading

- Blue Sky Analytics, “An Introduction to Carbon Credits”, https://blueskyhq.io/blog/an-introduction-to-carbon-credits#close-cookie

- Carboncredits.com, “Who Verifies Carbon Credits?”